10 Expense Tracker Printable for 2025

10 Expense Tracker Printable

1: Clean and Modern Expense Tracker Sheet

This sheet has a very simple and neat design without any clutter.

It has columns for you to write the date, what you bought, how much it cost, and a running total.

There is also a spot at the top to write the month and year, plus a notes section for any extra details.

It is perfect for anyone who wants an easy, no-fuss way to write down what they spend each day.

2: My Money Tracker

This printable focuses on your entire month of money in and money out.

It has a section to list all your monthly income and another for your fixed bills like rent and internet.

You then list other spending in categories such as food, gas, fun, and shopping to see where your cash goes.

This is great for people or families who want a full picture of their monthly finances in one place.

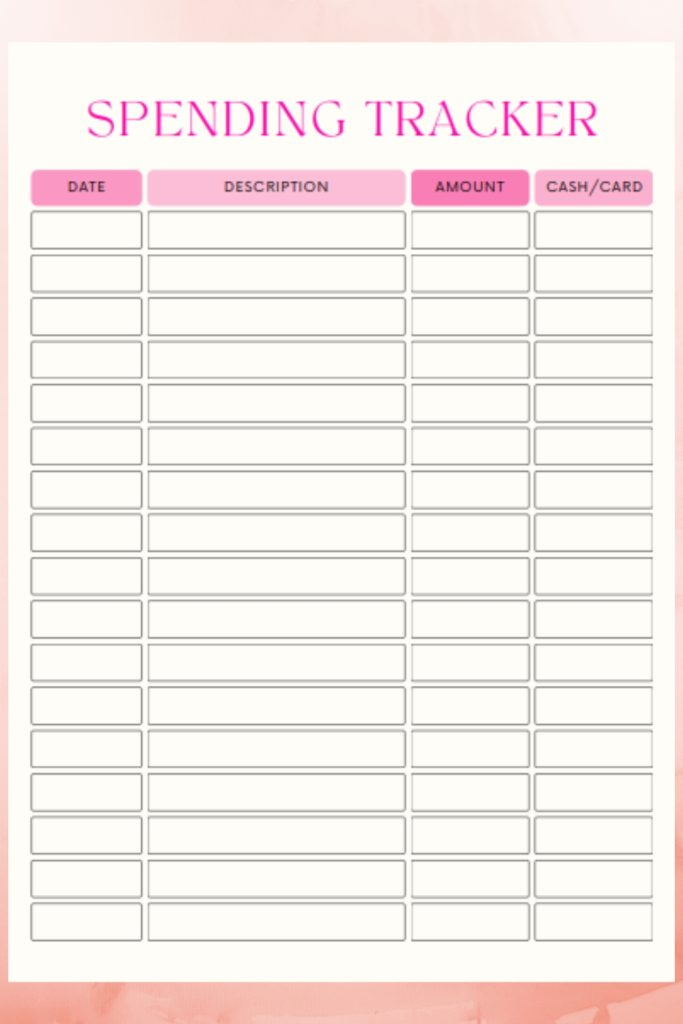

3: Spending Tracker

This tracker is made for writing down every single purchase you make day by day.

For each expense, you write the date, what it was for, the amount, and if you paid with cash or a card.

This detailed log helps you understand your daily spending patterns very clearly.

It is ideal for anyone who wants to keep a very close watch on where every dollar is spent.

4: Expense Tracker with Fixed Expenses

This sheet helps you plan for both your regular bills and your changing costs.

It has a list for fixed expenses like your mortgage, car payment, and insurance.

Then it has other categories for things like doctor visits, gym memberships, and school costs.

Using this makes sure you remember all your important bills while also tracking your other spending.

5: Monthly Expense Tracker

This tracker organizes your spending by the month.

For every purchase, you fill in the date, a description, which category it belongs to, the amount, and any notes.

Having a notes section lets you add reminders, like if a cost was for a special event or a work expense.

It is a flexible tool for people who like to review their finances one month at a time.

What are Benefits of Expense Tracker?

Writing down your expenses helps you see exactly where your money is going each month.

This makes it easy to notice if you are spending too much in one area, like eating out or online shopping.

Being organized with a tracker reduces worry about money because you have a plan and know what to expect.

It helps you stick to a budget so you can avoid overspending and save more for your goals.

Overall, using a tracker puts you in control of your finances and leads to smarter decisions with your money.